More than half of Singapore’s small businesses anticipate growth this year. Innovation remains a key driver of business growth in 2024. Almost half anticipate being cyber attacked.

More than half of Singapore’s small businesses anticipate growth this year. Innovation remains a key driver of business growth in 2024. Almost half anticipate being cyber attacked.

SINGAPORE, March 27, 2024 /PRNewswire/ — Small businesses in Singapore are gearing up for a promising year of growth and innovation, according to a new survey by global professional accounting body CPA Australia.

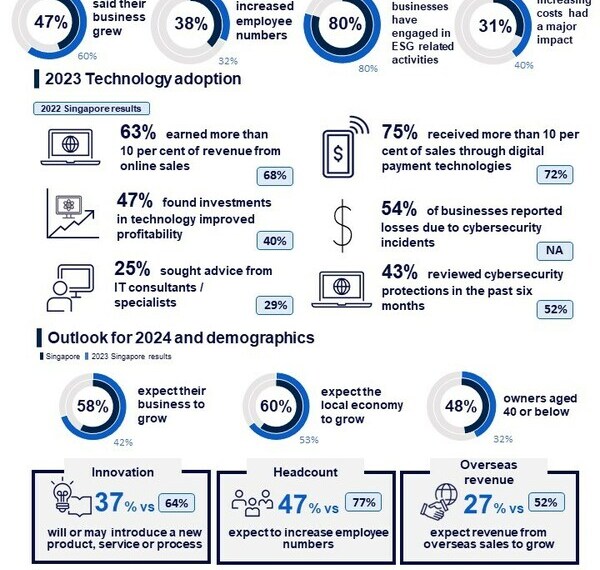

Singapore’s key highlights from CPA Australia Asia-Pacific Small Business Survey 2023-24

Singapore’s key highlights from CPA Australia Asia-Pacific Small Business Survey 2023-24

The annual Asia-Pacific Small Business Survey found that 58 per cent of small businesses in Singapore foresee growth this year, marking the highest level of optimism since 2018. Notably, a quarter of these businesses anticipate robust growth in 2024, a result not seen since the aftermath of the global financial crisis in 2011.

Major contributors to this positive sentiment include growing small business confidence in the local economy, and the strong focus many small businesses in Singapore have on innovation and technology, improved customer satisfaction, and venturing into new markets.

The survey of business owners and senior managers across 11 markets also highlighted the prominent role of younger small business owners in driving growth. Nearly half (48 per cent) of respondents who were business owners or CEOs were aged under 40, compared with the survey average of 43 per cent. Younger business owners are more likely to use technology such as e-commerce and social media, innovate, and are less risk adverse than older owners, the survey found.

Recent data from the Singapore Commercial Credit Bureau (SCCB) reinforces this positive outlook, with local business sentiment hitting a one-year high in the second quarter of 2024. The Business Optimism Index rose for the third consecutive quarter in Q2 to +4.82 percentage points, up from +4.48 percentage points in Q1 2024.

CPA Australia Singapore Divisional President and Reputation and Risk Leader at Deloitte Southeast Asia, Cheung Pui Yuen, echoed this sentiment.

"The upbeat outlook is a testament to the resilience of Singapore’s small businesses to innovate, persevere and think out-of-the-box. As we navigate through a gloomy global economy plagued with many uncertainties, this positive mindset will serve as a catalyst for unprecedented growth and success," Cheung said.

Singapore’s small businesses are poised to embrace innovation in 2024, with 37 per cent of survey respondents intending to introduce new products, processes or services unique to the market or the world. This is the third highest result of the 11 markets surveyed, and up from 21 per cent last year. This commitment to innovation is reflected in the survey results, which show a positive correlation between innovation and business growth.

CPA Australia Divisional Deputy President and Digital Business and Risk Services Leader at PwC Singapore, Greg Unsworth, said, "Innovation is the lifeline of small businesses and is a necessity to thrive in today’s dynamic landscape. By fostering a culture of innovation, businesses can unlock new opportunities and drive sustainable growth."

The survey found that small businesses that experienced growth last year also hired more staff. More than a third (38 per cent) added to their headcount, up from 25 per cent in 2022. Nearly half (47 per cent) of small businesses in Singapore expect to grow their workforce in 2024 to meet the increasing demands on their business.

The survey results showed a growing trend towards the adoption of ESG with 80 per cent of small businesses in Singapore engaging in ESG-related activities. Many local small businesses are focused on the adoption of environmental management system (EMS), ensuring supply chain sustainability, and investing in renewable energy.

Despite the optimistic outlook, cybersecurity remains a concern for small businesses in Singapore. More than half (54 per cent) reported losses due to cybersecurity incidents in 2023, surpassing the survey average of 41 per cent. About 45 per cent anticipate cyber attacks this year. Despite this, only 43 per cent reviewed their cybersecurity measures in the past six months, highlighting the urgent need for enhanced cybersecurity measures to safeguard their operations and data.

CPA Australia’s Asia-Pacific Small Business Survey, including a detailed summary of the results for Singapore and an infographic

About the survey

CPA Australia’s 15th annual Asia-Pacific Small Business Survey was conducted among small business owners/senior managers during November and December 2023 to identify the characteristics of successful small businesses across the region. More than 4,000 small businesses with fewer than 20 employees from Australia, Mainland China, Hong Kong, India, Indonesia, Malaysia, New Zealand, Philippines, Singapore, Taiwan, and Vietnam were surveyed.

About CPA Australia

CPA Australia is one of the largest professional accounting bodies in the world, with more than 172,000 members in over 100 countries and regions, including more than 8,600 members in Singapore. CPA Australia has been operating in Singapore since 1954 and opened our Singapore office in 1989. Our core services include education, training, technical support and advocacy. CPA Australia provides thought leadership on local, national and international issues affecting the accounting profession and public interest. We engage with governments, regulators and industries to advocate policies that stimulate sustainable economic growth and have positive business and public outcomes. Find out more at cpaaustralia.com.au

This content was prepared by our news partner, Cision PR Newswire. The opinions and the content published on this page are the author’s own and do not necessarily reflect the views of Siam News Network

![Participants take a photo at the 2024 World Internet Conference Wuzhen Summit in Zhejiang province. The WIC Wuzhen Summit, held for 10 consecutive years, ended on Friday. [NI YANQIANG/FOR CHINA DAILY]](https://cfr2.thailandbusinessnews.net/2024/11/Participants_a_photo_2024_World_Internet_Conference_Wuzhen_Summit_Zhejiang-120x86.jpg)