BRUSSELS, Feb. 1, 2024 /PRNewswire/ — Results for the year ending 31 December 2023

Financial highlights

Euroclear continues to separate Russian sanction-related earnings from the underlying financial results and retain these profits until further guidance is provided on the distribution or management of such profits.

Underlying business income reached a record EUR 1,658 million, an increase of 3% year-on-year. Underlying net profit increased by 63% to almost EUR 1 billion, driven by a robust business performance and a high interest rates environment. Underlying operating expenses increased by 14% to EUR 1,290 million, on higher inflation and increased investments in line with our strategic ambition to develop digital capabilities and IT infrastructure. The impact of inflation on the group’s workforce and non-payroll related costs accounted for an increase of around 5% compared to 2022. Net interest earnings amounted to EUR 5.5 billion, of which EUR 4.4 billion relate to interests linked to Russian sanctions. The Russian sanctions and countermeasures resulted in direct costs of EUR 62 million and a loss of business income of EUR 24 million. Group impairments were recorded in 2023 totalling EUR 125 million, principally related to the impairment of part of the goodwill of our Swedish CSD. The harsher economic conditions and reduced volumes combined with an increase in costs are expected to persist, leading to reduced long-term projections. This has resulted in an impairment of EUR 100 million of the goodwill of the group’s Swedish CSD. Euroclear achieved an underlying EBITDA margin of 57.4%, an increase of 9.7 percentage points compared to 2022. Underlying earnings per share rose by 63% to EUR 312.1 per share, reflecting the continued increase in net profit. The Board proposes to pay a dividend per share of EUR 210 in the third quarter of 2024. This represents an increase of 82% and maintains the pay-out ratio at 60% of the underlying earnings.

Lieve Mostrey, Chief Executive Officer of Euroclear Group, commented:

"2023 was another turbulent year, with geopolitical tensions impacting our macro-economic reality and the global capital markets. In times of complexity and market uncertainty, it is rewarding to know that our diverse client base continues to rely on us for safety and efficiency in processing and safeguarding their assets.

In 2023, we reached a record underlying business income of EUR 1,658 million and an underlying net profit of almost EUR 1 billion, driven by a robust business performance and a high interest rates environment. We also made solid progress in delivering on our strategic objectives, maintaining our focus on clients, while further developing ESG, data and digital capabilities, and continuing to grow our business internationally. Key achievements include the launch of the Digital Securities Issuance (D-SI) service, the successful connection of Euroclear Bank and Euroclear Finland to the European Central Bank’s T2S settlement system and the opening of a new Tech Hub in Krakow, allowing us to create 400 new jobs.

As we recently announced a leadership transition and the selection of Valérie Urbain as my successor, this is my last set of full-year results as CEO of Euroclear. I would like to take this opportunity to thank our colleagues across the entire group for their commitment and dedication in delivering another robust performance, servicing our clients and contributing to preserve the certainty, fluidity, and safety of our markets."

Financial overview

Euroclear Holding

(€ m)

FY 2022

Russian sanctions impacts

FY 2022 Underlying

FY 2023

Russian sanctions impacts

FY 2023 Underlying

Underlying vs 2022

Operating income

2,769

814

1,955

7,171

4,400

2,771

816

42 %

– Business income

1,600

-7

1,607

1,634

-24

1,658

51

3 %

– Interest, banking & other income

1,170

821

348

5,537

4,424

1,113

765

219 %

Operating expenses

-1,152

-20

-1,133

-1,351

-62

-1,290

-157

-14 %

Operating profit before Impairment

1,617

795

823

5,820

4,339

1,481

658

80 %

Impairment

-12

-1

-12

-125

0

-125

-113

Pre tax profit

1,605

794

811

5,695

4,339

1,356

545

67 %

Tax

-405

-197

-208

-1,459

-1,085

-374

-166

-80 %

Net profit

1,200

597

603

4,236

3,254

982

380

63 %

EPS

381.3

191.5

1346.0

312.1

Business income operating margin

28.0 %

29.5 %

17.3 %

22.2 %

EBITDA margin (EBITDA/oper.income)

62.3 %

47.7 %

82.7 %

57.4 %

Robust business performance in subdued market conditionsWith a record underlying business income of EUR 1,658 million (+ 3% year-on-year), Euroclear continues to deliver growth despite subdued market conditions. In contrast with 2022, which was characterised by volatile markets following the invasion of Ukraine, 2023 saw market activity slightly decrease while equities valuations recovered. Fixed-income issuance performed well. The diversification of Euroclear’s business continues to provide resilience thanks to its subscription-like model as approximately three quarters of the group’s business income is decoupled from financial market valuation.

Eurobond and European assets performance resulted from solid issuance and partial recovery of equities valuations, in spite of lower levels of trading compared to last year in most markets. The investment funds business also suffered from lower activity mainly impacting mutual funds. ETF investment remained strong. Revenue emanating from the Collateral Highway increased despite reduced volumes for lending and borrowing. Global and Emerging Markets performance remained solid amid interest in new, emerging markets.

Key business drivers

FY2022

FY2023

YoY evolution

3-year CAGR

Assets under custody

€35.5 trillion

€37.7 trillion

+6 %

+4.8 %

Number of transactions

304 million

299 million

-2 %

+2.8 %

Turnover

€1,066 trillion

€1,072 trillion

+1 %

+6.1 %

Fund assets under custody

€2.8 trillion

€3.1 trillion

+10 %

+6.5 %

Collateral highway

€1.79 trillion

€1.67 trillion

-7 %

+2.7 %

Underlying cash deposits (year average)

€25.8 billion

€23.7 billion

-8 %

+4.8 %

Quarterly evolution of key business drivers

Q1 2023

Q2 2023

Q3 2023

Q4 2023

Assets under custody (in EUR billion)

36,586

36,830

36,952

37,714

Number of transactions (in million)

79.10

72.98

71.69

75.47

Turnover (in EUR billion)

281,091

265,108

266,905

259,382

Fund assets under custody (in EUR billion)

2,902

2,989

3,014

3,111

Collateral highway (in EUR billion)

1,747

1,678

1,668

1,670

Underlying cash deposits (in EUR billion)

25.5

25.4

22.1

22.0

In 2023, Euroclear progressed the renewed Group Strategy announced in 2022, laying the foundations for the next phase of Euroclear’s diversification and growth.

Embracing digital assets In line with Euroclear’s aspiration to become a digital and data-enabled financial market infrastructure, a D²-FMI, it launched its new Digital Securities Issuance (D-SI) service in September 2023.

The service enables the issuance, distribution and settlement of fully digital international securities – Digitally Native Notes (DNN) – on distributed ledger technology (DLT). The inaugural DNN was issued by the World Bank, raising EUR 100 million to support its sustainable development activities. The DNN is automatically linked to the traditional settlement platform of Euroclear for secondary market operations, ensuring investors full access to liquidity.

Separately, in December 2023, Fnality, an international consortium of banks and financial institutions, including Euroclear, announced it had completed the first blockchain payments at the Bank of England. Fnality aims to bring central bank money in a digital tokenized form with near-real-time 24/7 settlement capability to allow banks to significantly reduce their intraday liquidity requirements.

Growing the funds business

Building on its acquisitions of MFEX and Goji, Euroclear has continued to enhance its service offering in investment funds with the launch of a new service targeting private market funds. Leveraging Goji’s capabilities and the FundSettle platform, the new service complements Euroclear’s existing money market, mutual and alternative fund offerings. The launch of the new service also follows the gradual inclusion of MFEX’s distribution and data services into the FundSettle platform.

To further streamline Euroclear’s funds offering and reflect its ambition to create a true one-stop-shop offering to clients across the full spectrum of funds products, Euroclear’s funds offering transitioned to a new brand name, Euroclear FundsPlace.

Euroclear also continued to deploy innovative services for fund distributors globally. In 2023, several clients from Europe and Asia chose Euroclear’s fund platform for the onboarding of their investment funds. Euroclear provides a one-stop-shop solution for fund distribution and execution services via its extensive network, allowing these clients to have access to more than 100,000 funds.

Forging stronger connections

Euroclear fully supports the need for integrated, deep and liquid capital markets within the European Union. As a common settlement platform for Europe, the European Central Bank’s TARGET2-Securities (T2S) system underpins this harmonised environment.

Euroclear Bank and Euroclear Finland successfully completed the connection to the European Central Bank’s T2S settlement system in late 2023. By joining this common infrastructure, the Finnish CSD can offer its users delivery-versus-payment settlement of securities and cash in euro and Danish krone central bank money.

Euroclear also continues to grow its international ecosystem in Asia. Euroclear Bank and the Korea Securities Depository took further step in making the Korean market "Euroclearable" by signing an agreement to open an omnibus account structure in August 2023. The link will allow international investors efficient post-trade access to KTBs.

Acting responsibly

In 2023, Euroclear continued to build on its strong ESG foundations established in previous years. It has started work on implementing the principles laid out in its ESG Board policy and begun to measure progress against the ESG KPIs which were approved in early 2023. Euroclear has made progress against its commitments in many areas, meeting its supply-chain screening targets, receiving approval for its targets from the Science Based Targets initiative (SBTi) and broadening its training offer. Actions are ongoing to integrate ESG into its current service offering, together with its business partners Impact Cubed and Greenomy.

Within its workplace, Euroclear aims to foster a healthy, performant and learning-orientated corporate culture. Last year, Euroclear onboarded 800 new employees and started to work with the World Economic Forum as one of its partners for ‘The Good Work Alliance’ which commits to building a more resilient, equitable, inclusive and just future of work.

Shareholder evolution In recent years, Euroclear’s shareholder base has evolved from its traditional "user-owned" model to include a greater proportion of longer-term institutional investors. In 2023, the group welcomed two new shareholders: New Zealand Super Fund and Novo Holdings, each holding 4.99% and 3.22% respectively.

Furthermore, two of Euroclear’s main shareholders reinforced their holding last year. Société Fédérale de Participations et d’Investissement (SFPI/FPIM) acquired 1.79% from various sellers, and now holds 12.92%, while Caisse des Dépôts et Consignations (CDC) increased its holding by 4.19%, and now holds 10.91%.

The long-term investment vision and commitment of this increasingly diversified shareholder base strengthens Euroclear’s position as a neutral and open financial market infrastructure.

CEO transition As announced on 15 January 2024, Valérie Urbain has been chosen by the Board as the successor to Lieve Mostrey as Chief Executive Officer of the Euroclear group. Having received the relevant regulatory approvals, Lieve Mostrey and Valérie Urbain will ensure a smooth and orderly transition period until the renewal of the Euroclear Board member mandates at the General Meeting on 3 May 2024.

Lieve Mostrey has led Euroclear as group CEO since January 2017. Under her tenure, Euroclear grew its business, expanded its global footprint, enriched its funds offering notably through the acquisitions of MFEX and Goji and accelerated value creation for shareholders, while at the same time securing CSDR licenses for each of its operating entities.

With over 30 years of experience at Euroclear in a variety of senior roles, including as Head of Human Resources of Euroclear Group, CEO of Euroclear Bank and most recently as Chief Business Officer, Valérie brings unparalleled knowledge of Euroclear, clients and market trends. She has been a key architect of its successful business strategy.

Update on Russian sanctions and countermeasuresThe number of sanctions and countersanctions that have been introduced since February 2022 are unprecedented and continue to have a significant impact on the daily operations of Euroclear. While new sanctions were issued at a declining pace in 2023, these still resulted in more breakage of straight-through process and increased manual interventions.

Well-established processes are in place which allow the group to implement the sanctions, while maintaining the normal course of business. However, one consequence of the sanctions is that blocked coupon payments and redemptions owed to sanctioned entities results in an accumulation of cash on Euroclear Bank’s balance sheet. At the end of 2023, Euroclear Bank’s balance sheet had increased by EUR 38 billion year-on-year to a total of EUR 162 billion.

Euroclear’s priority has been to manage the sanctions according to the spirit and letter of the law. As per Euroclear’s standard procedures, Euroclear does not remunerate cash balances and such cash balances are re-invested to minimise risk and capital requirements. Prudent management of such risks is a requirement under Euroclear’s Risk Appetite and Policies and expected by the EU Capital Requirements Regulation. The interest received on the reinvestment of cash balances is net interest income earned by Euroclear.

In 2023, interest arising on cash balances from Russia-sanctioned assets was approx. EUR 4.4 billion. Such interest earnings are driven by two factors: (i) the prevailing interest rates and (ii) the amount of cash balances that Euroclear is required to invest. Subject to Belgian corporate tax, these earnings will generate EUR 1,085 million tax revenue for the Belgian State in 2023. As such, future earnings will be influenced by the evolving interest rate environment and the size of cash balances as the sanctions evolve.

Since considerable uncertainties persist, Euroclear considers it necessary to separate the estimated sanction-related earnings from the underlying financial results when assessing the company’s performance and resources.

Euroclear is faced with a high level of complexity in managing both the wide-ranging package of sanctions and a set of countermeasures, which Russia has implemented to try to mitigate the impact of the sanctions. Euroclear allocates considerable time, resources and capital to manage market issues, potential risks and implications of these countermeasures, while maintaining regular dialogue with clients and other stakeholders.

Overall, Euroclear incurred additional direct costs from the management of Russian sanctions of EUR 62 million in 2023, with considerable senior management and Board focus on the topic. Additionally, the international sanctions and Russian countermeasures have resulted in a loss of activities from sanctioned clients and Russian securities, which negatively impacted business income by EUR 24 million.

2023 also saw various parties contest the consequences of the application of sanctions, with a significant number of legal proceedings ongoing, almost exclusively in Russian courts. Claimants have initiated legal proceeding aiming mainly to access the assets blocked in Euroclear’s books. Despite all legal actions taken by Euroclear and the considerable resources mobilised, the probability of unfavourable rulings in Russian courts is high since Russia does not recognise the international sanctions. Euroclear will continue to defend itself against all legal claims.

In parallel, the Board notes that the European Commission is contemplating various options to use the profits generated by the reinvestment of sanctioned amounts held by financial institutions, including Euroclear, for the financing of Ukraine’s reconstruction.

Euroclear is focused on minimising potential legal and operational risks that may arise for itself and its clients from the implementation of any proposals from the European Commission. The company continues to act in a transparent manner with all authorities involved and to retain profits related to the international sanctions applicable on Russian assets until further guidance is provided on the distribution or management of such profits.

Euroclear continues to monitor and assess the potential impact of post balance sheet events on its 2023 financial statements.

Annexes

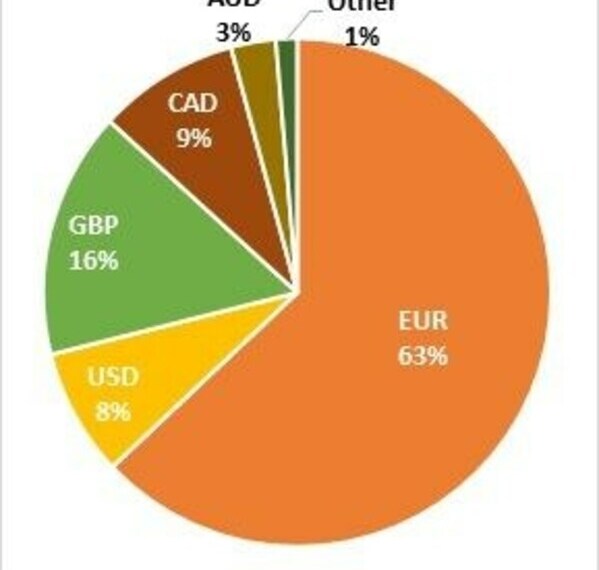

Cash balances related to Russian sanctions

Cash balances related to Russian sanctions

Cash balances related to Russian sanctions

Infographic – https://mma.prnasia.com/media2/2331196/Euroclear_1.jpg?p=medium600

"Business as usual" cash balances

"Business as usual" cash balances

"Business as usual" cash balances

Infographic – https://mma.prnasia.com/media2/2331195/Euroclear_2.jpg?p=medium600

Euroclear Bank and Euroclear Investments are the two group issuing entities. The summary income statements and financial positions at Q4 2023 for both entities are shown below.

Figures in Million of EUR

Q4 2023

Q4 2022

Variance

Euroclear Bank Income Statement (BE GAAP)

Net interest income

5,506.3

1,199.1

4,307.2

Net fee and commission income

1,085.8

1,033.7

52.1

Other income

22.2

-5.2

27.4

Total operating income

6,614.3

2,227.6

4,386.6

Administrative expenses

-866.3

-696.8

-169.5

Operating profit before impairment and taxation

5,747.9

1,530.8

4,217.1

Result for the period

4,295.1

1,147.6

3,147.5

Euroclear Bank Statement of Financial Position

Shareholders’ equity

6,897.2

2,953.4

3,943.8

Debt securities issued and funds borrowed (incl. subordinated debt)

4,522.6

5,399.0

-876.5

Total assets

161,567.3

123,569.9

37,997.3

Euroclear Investments Income Statement (BE GAAP)

Q4 2023

Q4 2022

Variance

Dividend

395.5

313.4

82.1

Net gains/(losses) on financial assets & liabilities

14.7

-2.9

17.6

Other income

0.0

-0.1

0.1

Total operating income

410.2

310.3

99.9

Administrative expenses

-1.3

-4.5

3.1

Operating profit before impairment and taxation

408.9

305.9

103.0

Result for the period

405.1

306.0

99.1

Euroclear Investments Statement of Financial Position

Shareholders’ equity

699.4

666.4

33.1

Debt securities issued and funds borrowed

1,656.5

1,655.1

1.4

Total assets

2,356.1

2,321.9

34.2

Euroclear Investments has been relocated from Luxembourg to Belgium on 31 December 2022 at midnight. The financial statements are now prepared under Belgian GAAP, and the 2022 figures have been restated accordingly.

Note to editors

Euroclear group is the financial industry’s trusted provider of post trade services. Guided by its purpose, Euroclear innovates to bring safety, efficiency, and connections to financial markets for sustainable economic growth. Euroclear provides settlement and custody of domestic and cross-border securities for bonds, equities and derivatives, and investment funds. As a proven, resilient capital market infrastructure, Euroclear is committed to delivering risk-mitigation, automation, and efficiency at scale for its global client franchise. The Euroclear group comprises Euroclear Bank, the International CSD, as well as Euroclear Belgium, Euroclear Finland, Euroclear France, Euroclear Nederland, Euroclear Sweden and Euroclear UK & International.

Contact:

Thomas Churchill thomas.churchill@euroclear.com +32 471 63 65 35

Pascal Brabant pascal.brabant@euroclear.com +32 475 78 36 62

This content was prepared by our news partner, Cision PR Newswire. The opinions and the content published on this page are the author’s own and do not necessarily reflect the views of Siam News Network